In the realm of investment portfolios, capital allocation plays a pivotal role in shaping financial success. By strategically distributing resources across various asset classes, investors aim to achieve optimal returns and mitigate risks. Let’s delve into the nuances of capital allocation and explore its impact on portfolio performance.

As we navigate through the intricacies of capital allocation, we will uncover key strategies and considerations that can elevate investment outcomes.

Capital Allocation in Investment Portfolio

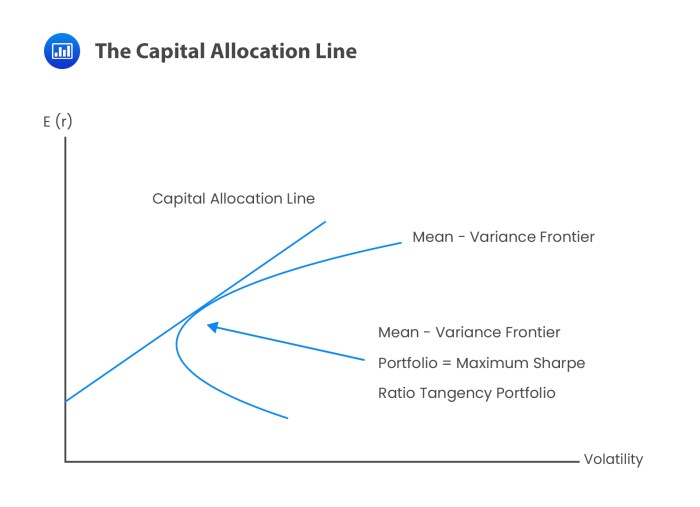

Capital allocation in investment portfolios refers to the process of distributing funds among different asset classes to achieve a balance between risk and return. By strategically allocating capital, investors aim to optimize their portfolio performance while managing risk effectively.

Asset Classes for Capital Allocation

- Equities: Investing in stocks of publicly traded companies.

- Bonds: Allocating funds to fixed-income securities issued by governments or corporations.

- Real Estate: Investing in properties such as residential, commercial, or industrial real estate.

- Commodities: Allocating capital to physical goods like gold, oil, or agricultural products.

Importance of Diversification

Diversification plays a crucial role in capital allocation strategies as it helps reduce the overall risk of the portfolio. By spreading investments across different asset classes, industries, and regions, investors can minimize the impact of market fluctuations on their overall returns.

Impact of Risk Tolerance

Investors’ risk tolerance, or their willingness to withstand market volatility, significantly influences capital allocation decisions. Those with a higher risk tolerance may allocate more capital to equities for potentially higher returns, while conservative investors may prefer a larger allocation to bonds for stability.

Capital Growth

Capital growth in the context of investments refers to the increase in the value of an investment over time. It is the appreciation of the initial capital invested, resulting in a higher value of the investment at a later date.

Strategies for Maximizing Capital Growth

Implementing certain strategies can help investors maximize capital growth in their portfolio:

- Diversification: Spreading investments across different asset classes can reduce risk and potentially enhance returns, contributing to overall capital growth.

- Regular Monitoring: Keeping track of market trends, economic indicators, and performance of investments can help investors make informed decisions to optimize capital growth.

- Reinvestment of Profits: Reinvesting dividends, interest, or capital gains back into the portfolio can accelerate capital growth through compounding.

Comparison of Investment Vehicles

Different investment vehicles offer varying growth potential:

| Investment Vehicle | Growth Potential |

|---|---|

| Stocks | High growth potential but also higher volatility. Suitable for long-term investors seeking capital appreciation. |

| Bonds | Relatively lower growth potential but provide income through interest payments. Considered less risky compared to stocks. |

| Real Estate | Offers growth potential through property value appreciation and rental income. Can provide a hedge against inflation. |

Role of Compounding in Capital Growth

Compounding plays a crucial role in achieving long-term capital growth. It involves reinvesting earnings and allowing them to generate additional earnings over time. The power of compounding can significantly boost the growth of an investment portfolio, especially when compounded returns are reinvested.

As we conclude our exploration of capital allocation in investment portfolios, it becomes evident that a well-crafted allocation strategy is essential for long-term financial growth. By understanding the dynamics of asset allocation and risk management, investors can navigate the complexities of the market with confidence and precision.

FAQ Resource

What is the primary goal of capital allocation in an investment portfolio?

The primary goal is to strategically distribute capital across various asset classes to optimize returns and minimize risks.

How does risk tolerance influence capital allocation decisions?

Risk tolerance plays a crucial role in determining the allocation of capital, as investors with higher risk tolerance may choose more aggressive strategies while those with lower risk tolerance opt for conservative approaches.

Why is diversification important in capital allocation strategies?

Diversification helps spread risk across different asset classes, reducing the impact of volatility on the overall portfolio performance.